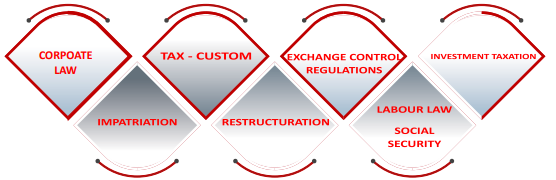

OUR EXPERTISE

Discover the diversity of our services, designed to meet your specific needs with expertise and dedication.

We offer multidisciplinary solutions through expert departments addressing all your administrative and advisory needs. The daily management of your company requires professionalism and security. We accompany you at the creation of your company and during its operation. We assist you in preparing for the transfer when the time comes. We are ready to meet your expectations, particularly in the following areas:

– TAX TREATMENT OF DAY-TO-DAY TRANSACTIONS (General tax advisory services)

• Transmission of any laws, decrees or other texts concerning taxes in Cameroun or CEMAC;

• Oral or written tax studies on all matters relating to your activities and its various

transactions;

• Assistance for the registration of any contract or act near the tax administration;

– TAX CONTROL

Assistance during any tax audit including:

• all meetings with tax administration,

• drafting of answers after receipt of each notification during each stage of the procedure,

negotiation of tax aspects within conventions or agreements with the State of Cameroon);

– Due diligence and tax planning;

– Assistance for any negotiation of tax aspects within conventions or agreements with the tax

Administration or the State of Cameroon.

– Audit of taxable income;

– Audit of the deductibility of expenses recorded;

– Analysis of tax optimisation options;

– Audit of latent tax and social risks and recommendations to ensure control;

– Control of supplier invoices…

CUSTOMS LAW

- Assistance in obtaining and implementing special customs procedures.

- Review of the implementation of preferential customs measures.

- Compliance audit (import and export procedures...).

- Advice on issues of value for duty, origin and tariff species.

- Advice and defence in customs control and litigation.

- Support in customs transactions.

- Development of customs procedure manuals.

- Obtaining, monitoring and implementing economic regimes, benefits.

CORPORATE LAW

Development of various corporate law consultations

• Development of contracts of all kinds

• Various consultations on social law, labour law and the CNPS

• Drafting of employment contracts for local employees

• Assistance in individual staff termination procedures

• Development of various commercial law consultations

• Participation in meetings on technical topics

• Assistance in administrative drafting, work sessions and obtaining

accreditation near the various Administrations related to your activity.

RESTRUCTURATIONS

- Recapitalisation

- Mergers

- Company dissolution

- Demergers

- Partial contribution of assets agreement

- Transfer of business

- Asset disposal

- Transfer of shares

- Leasing-management

TAXATION AND SOCIAL SECURITY, LABOUR

Assistance shall cover the following aspects:

- Various consultations on social law: labour law and contributions near the

National Social Insurance Funds (in french CNPS)

- Drafting of employment contracts for local and expatriate employees

- Assistance with individual staff redundancy procedures

- Full assistance with CNPS controls

- Assistance during Labour Inspection checks

- Assistance during LME procedures (dismissal for economic reasons)

- Assistance on the social aspect of restructuring procedures - Outsourcing of

payroll...

EXPATRIATION OF PROFESSIONALS AND EXECUTIVES

– Expat status in a country

– Drafting of the labour contract

– Optimization of revenue

– Transfer of revenue

– Residence permit

– Work visa

FOREIGN EXCHANGES

– Task of control of your operations

– Drafting of contract, set up files in accordance with the law and practice

– Reporting according requirements of various administrations

– Assistance during exchange controls

FOREIGN EXCHANGES

– Task of control of your operations

– Drafting of contract, set up files in accordance with the law and practice

– Reporting according requirements of various administrations

– Assistance during exchange controls

Schedule Your Appointment

Schedule an appointment with us today and benefit from our expertise.